human capital management (HCM)

What is human capital management (HCM)?

Human capital management (HCM) is a comprehensive set of practices and tools used for recruiting, managing and developing employees as a valuable business asset rather than just as a business cost. HCM also refers to the category of software used by organizations to automate recruitment, management and development of their workforces.

Why is human capital management important?

HCM addresses the challenges most organizations face around their biggest investment: people. Here's where HCM comes in. Investing in people as human capital can boost employee creativity and productivity, and ultimately, an organization's business outcomes, value, and profitability. Failure to practice HCM can result in missed opportunities, lost revenue and higher labor costs, all of which can seriously damage a firm's financial stability and competitiveness.

HCM practices and solutions can help organizations speed up recruitment and recruit talented individuals with the right skills. Modern HCM tools include features that aid companies in optimizing workforce/talent management, workforce spending, and succession planning.

The right tools with analytics and artificial intelligence (AI) capabilities help organizations to do the following:

- Streamline HR operations.

- Predict attrition.

- Improve compensation structures.

- Enhance people-related decision-making.

HCM can also help organizations stay ahead of major workforce trends such as:

- Changing demographics. As the workforce ages, new generations of workers bring different styles and needs. Generation Z and millennials, for example, generally have high expectations for work-life balance.

- Gig economy. The upsurge of the gig economy complicates scheduling, contracts and compliance with tax and employment laws. HCM can help to ease the impact of these complications.

- Complex legislation. Laws and regulations change quickly, and noncompliance can lead to hefty penalties. HCM can ease the pressures organizations face to stay aware and compliant.

- HR data. Organizations collect massive amounts of internal and external data about their workforces. HCM technology can help decision-makers leverage this data to improve workforce productivity, engagement, and performance.

Human capital management (HCM) software

HCM software application suites enable HR teams to handle numerous HCM functions, including recruiting and performance management. In its 2020 Magic Quadrant report on cloud HCM suites, Gartner predicted that 60% of enterprises with more than 1,000 employees will invest in an HCM suite by 2025. HCM suites are sold either as components of enterprise resource planning (ERP) systems or as separate products that can be integrated with ERP. Well-known HCM vendors are ADP, BambooHR, Ceridian, Infor, Oracle Cloud HCM, SAP SuccessFactors, UKG and Workday.

In recent years, software as a service (SaaS) HCM has superseded on-premises human resource management systems (HRMS). SaaS HCM products are cloud-based, meaning the software is delivered as a subscription-based service to multiple organizations via the Internet. This approach is usually cheaper than on-premises HRMS software.

Functions included in HCM software

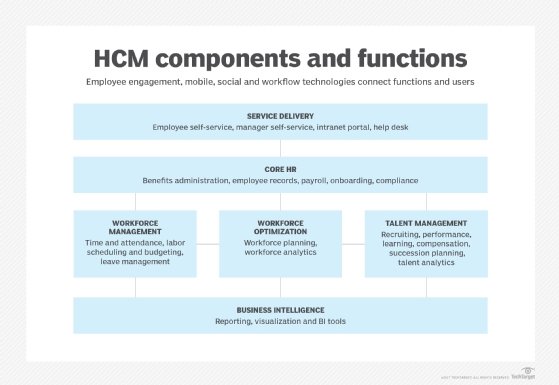

HCM software usually includes these functions:

- Core HR, including payroll, benefits administration, onboarding (bringing employees into the organization), compliance management, and employee data management/maintenance.

- Talent management, the process of recruiting, developing and retaining employees, managing their performance, compensation, learning, and performing succession planning.

- Workforce management, the set of functions for deploying employees to specific regions, departments, or projects based on requirements and their skills. It includes time and attendance management, workforce planning, labor scheduling and budgeting.

- Service delivery, including HR help desks, intranet portals, employee self-service, and manager self-service.

Several important technologies underpin these components, including analytics, social media, collaboration and mobility. Social media and collaboration tools can facilitate the frequent feedback and communication required for continuous performance management. Analytics makes HCM more strategic and helps align it with the company's financial success. Analytics tools might be localized to a particular HCM function such as workforce optimization.

Human capital management vs. human resource management

HCM connotes an approach to human resource management (HRM) that views employees as assets to be invested in and managed effectively throughout their lifecycle with the organization to maximize their productivity and business value. HCM transcends the traditional, mostly administrative functions of HR to include more strategic and employee-focused disciplines such as talent management and employee engagement.

HCM is both a set of HR processes and a category of HR software. In contrast, an HRMS is a set of integrated software applications and other technologies used to manage HR processes, especially core administrative ones like employee records, payroll and benefits.

HRMS is nearly synonymous with an older, less commonly used term, human resource information system (HRIS).

Of the three, HCM is a much broader umbrella term for HR software and the one vendors use most often.

Challenges of human capital management

Certain areas of HCM are notoriously difficult to manage and optimize:

- Employee engagement. It's hard to measure and improve engagement, though numerous methods can be used, such as implementing collaboration tools, sending out employee surveys, and making employee processes like onboarding easy and seamless.

- Leadership development. A serious, sustained effort is required to recognize employees' potential for leadership positions and provide effective training.

- Compensation and benefits. It can be difficult to get accurate, comparable data on industry rates to adjust compensation packages and stay competitive.

- Succession planning. It's difficult to get an accurate view of future organizational change required for optimal succession planning.

- Learning management. Older learning management systems are often incompatible with newer, web-based training sources, and educational content is hard to curate effectively and affordably.

- Employee retention. Employee turnover leads to loss of institutional knowledge and higher recruitment costs, but some companies struggle to understand its underlying causes. Also, boosting employee retention requires a strong HCM strategy that's not easy to create or execute.

History of human capital management

The term human capital dates back to the 17th and 18th centuries, when economists like Adam Smith aimed to quantify the value of labor productivity and earnings. Economic theories continue to influence HCM by equating employees to investments whose value to an organization depends on their skills, productivity, and creativity.

The formalization of worker management into a discipline began with the growth of scientific management theories around the turn of the 20th century, including studies by Frederick Taylor about worker efficiency. Industrial psychology, another discipline born in the early 20th century, addressed the factors -- besides pay -- that influence worker productivity, such as the Hawthorne effect, an increase in output caused by being watched.

The rise of labor unions also spurred companies to address worker compensation, safety and health. This may also be when references to people as a human resource first appeared.

In the 1920s and 1930s, worker protections in social programs such as U.S. President Franklin Roosevelt's New Deal led to the rise of industrial and labor relations as a formal discipline in corporations and governments. Around this time, personnel research became popular in academia and corporations started personnel departments. The field of personnel administration grew rapidly during World War II, and multiple associations were formed to further it as a discipline.

By the latter half of the 20th century, the idea that employees should be viewed as assets to be maximized gained further traction. Some academic and public policy experts began using the term human resource to convey this idea, and personnel management soon gave way to human resource management as a new discipline.

The future of human capital management

New technologies are emerging to make HCM processes more automatic, intelligent, and easy for both employees and HR professionals, including AI, machine learning, and natural language processing (NLP).

Recruitment chatbots, for example, use NLP to engage in realistic conversations with job candidates. ML parses resumes, saving human recruiters tedium and allowing them to focus on other strategic tasks like talent acquisition and succession planning. It also analyzes video interviews to help with decision-making during hiring and evaluates employees by recognizing patterns in their performance reviews to guide decisions about promotions. ML is also being applied to learning management to make recommendations for online training by analyzing employees' roles, career paths and performance.

AI-enabled chatbots and robotic process automation are helping to streamline HCM workflows, and also greasing the skids in employee and manager self-service applications.

Many HR departments now hire remote staff. HCM tools help them foster engagement with remote workers through personalized training, easier onboarding, and team collaboration platforms such as video chat and messaging.

Finally, modern-day workforce acquisition strategies depend on integrated HCM technologies to effectively manage full-time, part-time, and contingent workers and capture the maximum value from them to benefit the organization.

Check out our handy guide showing how to build your own employee journey map and check out 11 actions that will improve employee experience. Learn the key differences and similarities between human resource information system (HRIS) vs. human resource management system (HRMS) vs. human capital management (HCM). See how to choose an HR software system.