How to choose an HR software system in 2024: A complete guide

Buying the right HR tools is more critical than ever. This step-by-step guide to HR software will help you identify your needs and pinpoint the features that matter most.

An HR system is one of the most important purchases an organization makes. Nowadays, the stakes couldn't be higher. The market for HR tools has exploded, and people management has become an urgent priority amid the tight labor market that developed after the COVID-19 pandemic subsided.

This overview gets you off to a strong start. It explains all the key steps in setting up an effective buying process and identifies the HR software features that ultimately determine whether a product will meet your needs. The links in the guide take you to articles that provide more detail on important topics.

What is HR software?

HR software encompasses the myriad tools organizations use to manage daily HR processes, such as recruiting, onboarding, training, payroll, benefits, time and attendance, performance management and succession planning.

While HR software was originally inward facing and focused on the administrative tasks of HR departments, today's products make the art and science of developing the organization's human resources -- its people -- available to every employee.

Types of HR software

HR software usually comes as a suite of modules, each one designed for a specific HR process.

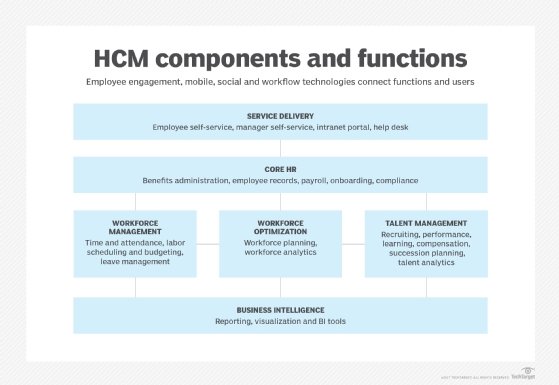

The most comprehensive platforms go by several names:

- Human resource management system (HRMS).

- Human resource information system (HRIS).

- Human capital management (HCM).

The terms are often used interchangeably, but there are some discernible differences in HRIS vs. HRMS vs. HCM. In short, HRIS and HRMS are near synonyms for actual software platforms you can buy, while HCM is an umbrella term for both HR processes and software.

These comprehensive suites of HR software typically include the following categories of software modules, which can often be bought separately:

- Core HR (benefits, employee records, payroll, etc.).

- Talent management (compensation, learning, performance, recruitment, succession).

- Workforce management (scheduling, time and attendance).

- Service delivery (employee and manager self-service, help desks).

Benefits of HR software

HR software enables organizations to digitize the record-keeping, computation and communication tasks performed by the HR department and distribute some of those responsibilities across the organization. Functions such as time and attendance, payroll, recruiting, regulatory compliance and benefits administration can be moved off paper and managed -- usually more efficiently -- on computers. This partial automation of manual tasks can reduce labor costs, streamline HR processes and make them more effective.

However, the effect of the technology goes far beyond these commonplace benefits of HR automation. When more employees perform better and reach their full potential, the result is often improved creativity and productivity that ultimately leads to higher profits.

Keys for evaluating HR software

How do you find the products that have the basic functions and specific features your organization needs the most? And how can you scrutinize vendor spec sheets and demos to compare products in enough detail to make the right choice?

"Features and functionality aren't much help because most products are mature and do the same things," said Brian Sommer, president of the TechVentive consultancy. "The issue is which products do a killer job of solving your most complicated, messed-up functions or process pain points."

One of the most common HR software buying mistakes is looking for products that automate existing processes. Sommer advised that organizations instead take time to investigate what's possible with the new and innovative HR technologies on the market, reimagine their HR or talent management processes, and then pick a vendor they believe can close the gap between idea and reality.

To do that, companies have to shift from viewing HR technology as something that serves the HR department to seeing it as a system that serves the needs of all employees, according to Katherine Jones, an independent HR technology consultant.

Here are more HR software selection tips:

- Create a strategy to evaluate HR tools. Define the organization's biggest workforce challenges, needs and goals.

- Assemble a cross-disciplinary buying team. Include representatives from HR, IT and finance, as well as departmental managers and staff who will use the software.

- Identify your requirements. List what is important to the organization in an HR software system. The criteria should cover technology requirements and business issues, such as international compliance needs.

- Identify potential vendors. Use a variety of research methods -- from reports to speaking with other companies -- to generate a list of possible vendors. Then, narrow it down to five to 10 vendors to approach for more information.

- Send a request for proposal to the shortlist of vendors. The RFP should be clear and concise and include information about your organization, the project, timeline, submission rules and scope, as well as a vendor questionnaire.

- View demos. They're the best way to judge a module or feature's capabilities. Ask each vendor to build demos around actual use cases from your organization. Fully scripted demos that show the exact steps for employees are the best way to tell if a product will deliver.

- Read case studies. Find customer stories that include deployment and adoption challenges. Ask vendors for reference customers who can answer questions directly.

Who is responsible for buying HR software?

Organizations need to put some thought into who should be on the HR software buying team. Below are typical roles and responsibilities.

Sponsor. This is the main person overseeing the project, typically someone in the C-suite, such as the chief human resources officer (CHRO), CIO or CFO. They make key decisions and keep the initiative aligned with the business strategy.

Selection manager. The selection manager is the de facto project manager for the product evaluation and selection process. This is often a senior HR manager, such as the HRIS director, or a member of the central project management office.

Selection advisor. Typically, this role is filled by an outside consultant, but it could be an internal person with similar expertise in requirements planning, RFP preparation and other formal steps.

Subject matter experts. These are the people who know the most about the important business processes the new system will manage, such as HR administration, payroll, benefits, recruitment and compensation.

Demo team. This group comprises HR staff and subject matter experts who will use the new system and can ask HRMS vendors questions related to departmental needs, along with IT staff who support those functions, including senior IT management.

RFI vs. RFP: Do you need both?

Sommer recommended against sending an overly detailed request for information (RFI) before the RFP.

"If you do an RFI, it's got to be something that's straightforward and easy for the vendor to complete," he said. Otherwise, they might not want to bother with the deal.

The aim of an RFI is to get a general idea of the breadth and depth of different types of software suites and whether they meet basic criteria, such as operating in the same countries as your organization. Its real value comes from other information submitted by the vendor, such as price lists, standard contracts and the names of implementation partners.

Sommer said the RFP should have a matrix with checkboxes for the vendor to indicate whether a feature is in the current version, on the roadmap for an upcoming version, is available through the customization tools included with the platform or is unlikely ever to be in the product.

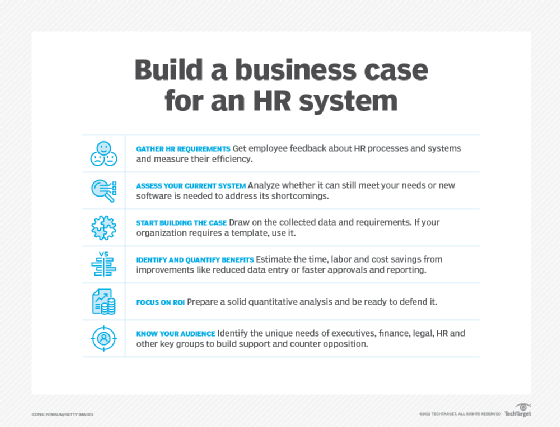

Building a business case for new HR software

HR software suites are not cheap (see section "How much does HR software cost?"). To buy such an expensive system, you first have to convince decision-makers to pay for it. That's why an HR software business case is essential. The best ones combine the quantitative analysis that impresses CEOs and finance directors with the qualitative information that reflects the daily needs of users.

Here are the major steps:

- Requirements gathering. Solicit feedback from users and key stakeholders on current HR processes and measure their efficiency.

- Systems assessment. Investigate the current HR system's ability to meet the identified requirements, costs such as HRIS maintenance, and what a new system could do.

- Templating. Collate the data, feedback and requirements in a standard document and prepare the business case.

- Benefits measurement. Quantify how the new system can improve HR processes.

- ROI calculation. Plug in costs and benefits metrics to show when the system begins to pay for itself.

- Audience identification. Identify the key stakeholders and decision-makers and gear the case to their individual needs.

HR software features to consider

Vendors will usually claim to handle most of your requirements, which makes it hard to choose between them. But certain features help separate contenders from pretenders. Here is a rundown of the features and leading-edge technologies that can make the biggest difference in improving HR processes, organized by the main software modules in core HR, talent management, workforce management and service delivery.

Core HR

The reason many companies, especially SMBs, buy their first HRMS is to create a paperless HR system. Electronic employee records are at the center of these systems and remain the foundation of HR technology.

One big differentiator, according to Sommer, is the presence of a payroll module. Some HRMSes don't have one. The next question to ask is about the type of integration with third-party payroll providers. An HRMS that handles payroll might need to outsource part of this function to pay overseas employees, for example.

Sommer said to also make sure core HR systems can fully handle contingent workers -- such as freelancers and contractors -- which includes providing accurate headcounts without needing separate types of software, and giving them security IDs and other tools full-time employees receive.

Close integration with the ERP finance module is essential, according to HR consultant Jones. It enables analysis of questions, such as whether to hire two part-timers or one full-timer for a certain job, or the most cost-effective way to get work done around the clock with a global workforce.

Benefits administration

Managing standard benefits, such as health, dental, life and disability insurance, 401(k) retirement plans, tuition reimbursement and tax-advantaged flexible spending accounts, is a longstanding function of core HR.

Many companies have been moving these functions from their on-premises computers to cloud-based providers. New health insurance platforms and wellness portals take healthcare beyond the basics to provide online access to providers, medical advice and fitness communities. If you're eyeing a separate health and wellness platform, Sommer advised making sure it integrates with financials so you can more easily manage the tax and compliance implications of health benefits.

When buying benefits technology, most of your focus will be on partnerships with benefit providers rather than the software used to administer them, according to Stacey Harris, chief research officer and managing partner at Sapient Insights Group. "I rarely will make a benefit selection decision just based off of user experience, as I might have done with talent management or core HRMS," Harris said.

The issue becomes whether a particular type of software integrates with your company's HRMS. "There's a real power in the relationship between the [benefits] package I want to create or the [provider] I want to work with and the assets or the software that it's connected with," she said.

Verify that a vendor supports your company's full menu of benefits. Also look for tools for tailoring the system to handle the complex workflows needed to administer your rules and policies, such as the ability to recover tuition funds or the option for employees to share vacation time.

Payroll

The payroll module or outside service should have the following:

- Support for every country where the company does business, which can be through a variety of payroll providers.

- The ability to create and file the appropriate tax documents and other compliance requirements.

- Integration with core financials, typically in ERP, to ensure accounting records reflect the latest payroll.

Compliance

HR departments are responsible for keeping an organization in compliance with the many regulations affecting employment, from fair labor practices to anti-discrimination laws and workplace safety. That's why it's important for core HRMS software to have a breadth of tools for not only monitoring business practices that can have legal implications but preparing all the paperwork required by local, state and national governments.

Check if vendors support the following:

- Every type of documentation, including all forms, tables and exhibits your organization is required to file.

- AI, analytics and other mechanisms for ensuring that talent management modules don't run afoul of discrimination laws by allowing sexism and other illegal biases.

- Employee records storage that follows privacy laws, such as the EU's GDPR, especially for HR software vendors who use public cloud services from other providers.

Onboarding

The onboarding process, especially an employee's first-day experience, can determine how long they stay.

"The big problem here is: Will the software integrate with all the non-HR solutions, and is there workflow and exception handling for all of that?" Sommer said.

To onboard an employee, HR professionals have to coordinate an array of processes, from issuing a security badge and laptop to ordering uniforms and scheduling orientation -- much of it in a specific sequence. Coordinating these steps requires an onboarding module that ideally integrates with the IT, time clock and other systems needed to set up a new employee.

Onboarding is often included in core HR, in part because it involves employee records, benefits and compliance. However, many vendors consider onboarding to be more of a talent management function because it comes right after the recruiting process, draws on corporate learning tools and potentially has a major impact on employee performance.

Offboarding is essentially the mirror image of onboarding, with the steps done in reverse order, according to Ben Eubanks, chief research officer at Lighthouse Research & Advisory.

Other features to investigate include the following:

- Integration with learning systems, so new employees can get quickly trained on required systems and processes and see future training opportunities for new career paths.

- Surveys and other tools that make it easy for departing employees to give feedback, regardless of whether they have done an exit interview; over time, it builds a database you can analyze.

Talent management

After core HR, talent management is the most important driver of HR software purchasing and product development.

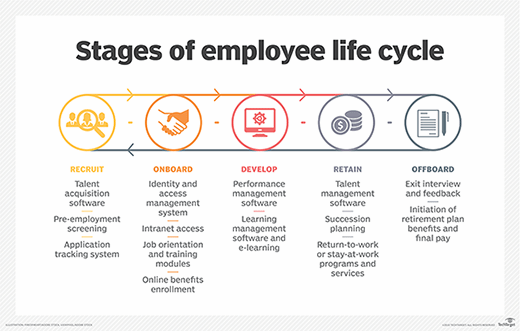

Talent management systems cover a vast array of disciplines and processes for bringing people with the right experience and potential into the organization, developing their skills, motivating them, assessing their performance, compensating them, and retaining them or easing their departure.

In recent years, the emphasis on talent management has shifted to skills development and greater awareness of how skills fit into job descriptions and career paths, according to Harris.

She said buyers should pay attention to how well a product can capture skills and translate them into job roles that are updated regularly. Doing so can help companies with difficult decisions, such as furloughs and layoffs.

Eubanks said one emerging way for companies to build skills is the use of gig marketplaces, a technology that began as a way for freelancers to find jobs but is now being used internally by companies to advertise projects that require certain skills to employees. "You are able to take advantage, in a positive way, and you're able to leverage the skills and the strengths of your workforce," he said.

"You have increased transparency from a career and skills development perspective, so they can see what the opportunities are to grow inside the organization," Eubanks added. Other benefits are improved employee retention and the ability to maintain productivity during hiring freezes.

Compensation management

Many companies have a giant spreadsheet that shows employee salaries and job titles, plus the salary ranges for each job, perhaps adjusted for local markets, according to Sommer. "The problem is, where do you get the data?" he said.

Ideally, the compensation management system comes with a pre-populated big-data service. If it doesn't, buyers should ask how much it costs to buy data from an outside provider and how current the information is. Salary databases are often outdated just when you need them for an employee's performance or compensation review.

Other differentiating features include the following:

- Support for specialized methods of compensation, especially variable compensation at companies that are heavily sales-oriented.

- Ease of use that makes it feasible to switch from spreadsheets to calculate merit raises and bonuses during regular compensation cycles.

Learning and development

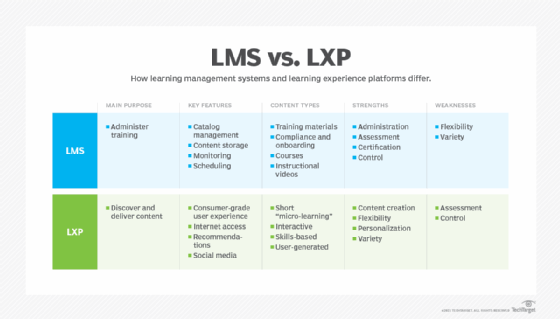

The on-premises learning management system (LMS) is a common legacy platform in organizations that were early to the HR software market. In recent years, many LMSes have been modernized and moved to the cloud.

But, the most important development in workplace learning is the rise of affordable new learning resources, such as short instructional videos on YouTube or TikTok and the free massive open online courses from universities and companies that specialize in distance learning.

Finding useful ready-made content is a challenge, according to Sommer. Companies often turn to third-party providers, but it can be expensive. For those that already have an LMS, the issue is whether it's possible to import content from these new sources. Leading-edge products have AI that can recommend training based on past selections and career paths, similar to the way Netflix's AI makes recommendations based on streaming history.

In recent years, learning experience platforms (LXPs) have begun to replace LMSes because of their ability to discover and deliver external content in a personalized, consumer-grade UI that gives employees more control over the learning process.

Some organizations add an LXP as their primary means of interacting with employees but retain their LMS for record-keeping, according to Eubanks. "That creates better experiences for your learners without having to unplug the LMS," he said. Purchasers who want to pursue this model should first understand the differences between an LXP and an LMS and make sure they are well integrated.

It's also important to have good integration between the career planning and learning features of the talent management suite: "When [employees] can actually look at a path and figure out what their gaps are, it makes it more actionable, and it helps them feel like they're making progress toward a goal," Eubanks said.

Also look for these options:

- A large variety of learning formats, including classroom, remote, paper-based, video and audio, both live and on demand.

- Capabilities that make it easy for employees to create learning content, such as recording videos on smartphones and providing searchable transcripts.

- A rich library of courses and materials on a wide range of relevant topics, including the tools that employees use in their jobs and courses that meet certification requirements of your industry.

- Support for experience API, an integration standard that helps apply analytics to learning to monitor employee use and improve the offerings.

Performance management

Companies have started moving from paper-heavy annual reviews to adopting continuous performance management, which provides tools for coaching and feedback to continuously improve employee performance. But continuous performance management has both pros and cons, and vendor support is uneven, according to Jeremy Ames, COO of Coligos Consulting.

"The annual performance review bashing started happening [several] years ago, and you still see plenty of vendors, especially full-suite vendors, who don't do a good job of it," he said.

Sommer said most organizations will do fine with performance management software that has strong support for the nine-box grid, a standard tool HR departments use in performance management and succession planning to rate the performance and potential of employees.

But analytics "is where the real action's at," he said. "The analytics are going to tell you where your problems and opportunities are." Workflow and exception-handling features help you do something about them.

Eubanks advised taking a careful look at social media and email integration, which are critical for prompting employees to send kudos and "nudges" to co-workers and making such feedback part of their daily workflow.

Also, look for the following capabilities:

- Integration with learning systems so employees can improve their skills or take mandatory training.

- Retention analytics to identify leaders and other high performers at risk of leaving.

- Integration with the compensation management module, which can provide the ability, for example, to analyze how modest across-the-board raises affect the morale of high performers.

Recruiting

The perennial war for talent makes recruiting difficult for many companies, whether it be during the economic recovery from the worst parts of the pandemic, when labor supplies were especially tight, to the recent layoffs in the tech industry and the remote and hybrid work challenges of today.

Talent management suites have more tools for recruiting than for any other HR function, and talent acquisition remains a trendy buzzword, with the market for recruiting software in constant flux and startups entering every year.

A company's tolerance for such innovation often determines what features it cares about, according to Ames.

Some organizations rank recruiting low in their requirements and only need basic functions, such as an applicant tracking system (ATS), online job postings and a process for moving candidates from the application stage to the job offer. Others know they want more innovative features.

In that case, the selection process should emphasize more advanced features, including candidate relationship management, the ability to pull in resumes from a variety of sources, LinkedIn connectivity and generally better visibility into candidates as they move through the hiring pipeline.

Check for the following features:

- SMS texting, which helps reach candidates who lack access to laptops or PCs and prefer texts over voice calls.

- Auditing that records every contact with a candidate on every communication platform you use.

- Natural language processing for analyzing unstructured data, such as text messages.

Succession planning

Some talent management suites have a succession planning module that helps in planning what should happen when executives and other high-value employees leave. It can also help retain good employees by spotting signs of dissatisfaction and providing career paths, according to Sommer.

Ease of use is critical here -- especially if people outside of HR, such as senior managers, need to use the tools.

The best tools also have the following features:

- What-if capabilities for considering different reporting structures and reorganizations, or the effect of corporate mergers on succession.

- An org chart tool, ideally one that goes beyond static PDFs and makes it easy to move large chunks around.

- Close integration with learning management tools to facilitate career development for employees earmarked for eventual promotion.

- The ability to plan succession for non-executive-level employees.

Job postings and job boards

Gone are the days of posting every listing to as many job boards as possible. Nowadays, job postings usually cost money, according to Sommer, shifting the priority to managing postings so they will be as effective as possible. Recruiting modules now have more tools to help create job descriptions and postings.

Important features include the following:

- Integration with popular job boards and others you want to use.

- Support for other digital channels, such as social media and text, for more precise targeting of promising candidates.

Video interviewing

Basic interviewing simply involves using webcams to replace in-person meetings. Video interviewing software is much more sophisticated: It lets an employer send the same set of questions to thousands of candidates to produce interviews in a consistent format, according to Sommer, and uses AI to analyze candidates. The technology is often used to winnow down the list for in-person second interviews, but it carries the risk of introducing AI bias in hiring.

HR technology consultant Jones advised giving careful scrutiny to services that record and manage the videos for you, which can be expensive. It's also important to ask who technically owns the videos, how long they're stored and accessible on demand, whether they can be downloaded and if they are ever shared with outsiders. Videos recorded in an ATS might require buying more storage capacity.

Look for these key features:

- Tools and procedures for detecting bias in the software's recommendations.

- Easy ways to move around and make notes in videos and jump quickly among videos.

- Automated transcriptions you can easily search for keywords that suggest skills your company needs.

Employee engagement and recognition

Employee engagement has been a growth area for tech startups, and major HR platform vendors have acquired these niche players or built their own tools. The dizzying number of options makes choosing one a special challenge. Sommer said ease of use is the most important criterion because users are often managers with limited tech skills.

Employee surveys are a popular tool for measuring and boosting employee engagement. The most helpful software has a large selection of pre-made surveys with cross-tabulation capabilities. Ease of use is again key because most users are HR staffers who aren't savvy about technology.

Also, look for the following options:

- Easy ways to attach documentation and data that support badges and other types of recognition.

- Strong integration with email and collaboration platforms.

- The ability to export recognition data to the performance management system.

- Fast return of survey results and the ability to synthesize data in near real time.

Workforce management

Workforce management systems enable organizations to monitor and improve employee productivity. In addition to tracking the time it takes to complete tasks and projects, workforce management can also identify opportunities to better schedule and deploy employees and skill sets.

Though it has obvious affinities with talent management, workforce management is a separate discipline, often with separate software devoted to it.

Workforce planning

The workforce planning component is heavy on HR analytics tools, as executives and HR managers parse external demographic and labor data alongside internal data to spot pending shortages or decide where to reassign employees to better address strategic priorities.

At the same time, workforce planning can be extremely detailed and help decide, for example, whether to call in two more retail clerks for a weekend sale.

Scheduling software is the primary tool of workforce planning. It's especially valuable if it lets employees schedule themselves while ensuring that shifts will be covered, which is key to retaining employees in certain professions, according to Sommer.

Also, check for the following:

- Daily tracking of individual employees' security credentials, including whether they have been revoked.

- Awareness of certification requirements of jobs, ability to assess the validity of certifications and their expiration dates, and links to an LMS or LXP for related training.

- Notification when employees are nearing weekly hours that will require paying them benefits or overtime.

Service delivery

The days when employees simply walked down the hall to ask a question or pick up a form at their HR department are a relic of the past. As companies digitize and more employees work remotely, service delivery has become an important aspect of ensuring employees receive the HR services they need.

HR service delivery is indeed a growth area in HR tech, according to Harris of Sapient Insights Group, with vendors adding help desks, chatbots and feedback tools.

The platforms can be challenging to set up in-house, integrate with HR systems and populate with enough data and documentation, which often makes them a better fit for large companies than for SMBs. Training chatbots for the particular needs and culture of an organization is another challenge.

Employee self-service (ESS)

Enabling employees to change their personal information, benefit elections and beneficiaries can save time and money for HR professionals.

Vendors have worked to make these employee self-service features available on employees' personal devices, but there are limits. "Trying to switch shifts with somebody may be impossible to do on a smartphone because there's just not enough screen real estate to get the whole picture," Sommer said.

Look for these features:

- Smartphone access to most self-service functions.

- Support for other devices -- including shop floor tablets, break room computers and point-of-sale systems -- if the workforce is mostly employees who lack smartphones and home computers and need other ways to access ESS.

Manager self-service

Managers need self-service features that go beyond ESS by providing access to the HR and business functions, applications and data they need to perform their supervisory roles.

Here's what to look for in manager self-service features:

- Remote access to the full range of applications, with the same level of security and privacy as in-house systems.

- Department-wide visibility into work schedules to help with vacation approvals and other changes.

HR software market and leading vendors

The market for HR software has grown to include hundreds of vendors and thousands of products. It is highly segmented, with around a dozen very large vendors offering full HCM suites or major components, including talent management -- most of which also compete in the broader market for ERP. Alongside the large vendors are numerous small providers of niche functions, such as candidate screening, LMS and employee engagement.

The large vendors that dominate ERP and have significant HR features -- and, in many cases, entire HCM platforms -- are Infor, Microsoft, Oracle, SAP and Workday. Smaller ERP players in HCM include Epicor, IFS, Sage, Syspro and Unit4.

A handful of large vendors outside ERP specialize in HCM and are among its market leaders: ADP, Ceridian, Cornerstone OnDemand and UKG -- which was formed from the merger of Kronos, a time management tools vendor, and Ultimate Software, an early leader in SaaS HCM.

Niche vendors that have influenced the HR software industry to a degree far exceeding their size, usually by inventing or productizing emerging technology that taps into a hot new demand, include the following:

- Qualtrics (customer and employee experience analytics).

- ServiceNow (IT help desks redesigned for employee self-service).

- Visier (people analytics).

These four vendors are among the leaders in applying AI to HR processes:

- HireVue (popularizer of AI-assisted video interviews).

- Pymetrics (behavioral assessments).

- BetterUp (coaching).

- ICIMS Text Engagement (formerly TextRecruit; recruitment chatbots).

How much does HR software cost?

It's no surprise that the biggest, most comprehensive systems are the most expensive. Leaving aside the priciest of all -- ERP, which companies usually buy as much for the financial module as the HCM -- HRMS and talent management suites cost the most.

Products targeting SMBs tend to be the least expensive. They can range from around $5,000 a year for a few dozen users to $100,000 for several hundred, which works out to less than $10 per user per month. Systems for large enterprises -- usually defined as having more than 1,000 employees -- are typically more expensive, starting at several hundred thousand dollars and exceeding $5 million for user bases in the tens of thousands. Vendors usually charge around half those amounts for each additional module, such as payroll or recruitment.

Pricing also depends on how the HR software is deployed. SaaS, in which the vendor maintains the system and provides access over the internet, is usually billed monthly with minimal upfront commitment. Systems that run on premises are usually licensed for a certain number of users for several years and paid for at the beginning. The per-user cost can be a bit cheaper with SaaS than on-premises systems, especially at the start, but numerous studies have shown that SaaS often costs more after seven to 10 years.

But the software isn't the only expense. There are usually labor costs for data cleansing and migration, as well as deployment and training, and often a hefty fee for a consultant or system integrator. On-premises systems usually require new hardware, and their annual maintenance costs can reach 20% of the software price.

Broken down differently, the total per-user monthly cost of a core HRMS averaged over five years is roughly $100 to $200, but it can be twice that much with additional modules.

Latest trends in HR software

Societal trends magnified by the pandemic have had a major impact on HR processes and software in tandem with the emerging technologies that are infiltrating business processes. Here are seven big trends:

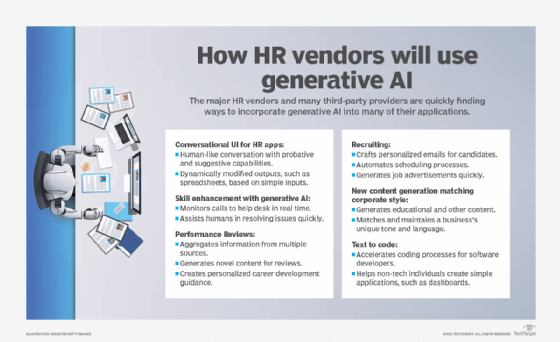

- AI. Artificial intelligence can spot patterns, choose among alternatives and make predictions -- in other words, all the things people do when recruiting, evaluating and developing talent. Automating those processes with AI can make them more accurate and efficient. Most HR software vendors are aggressively adding AI capabilities, including newer generative AI with humanlike communication skills for writing recruitment emails, creating educational content and developing career paths. But there are major concerns that the technology can sometimes amplify rather than eliminate racism, sexism and other biases. Companies are also uneasy about leaving important decisions up to a technological "black box."

- Augmented reality and virtual reality. AR overlays digital information on a real-world environment, while VR attempts to digitally simulate an entire environment. Both are beginning to transform corporate learning by providing virtual hands-on experience with the tools and procedures employees need to learn for their jobs. The use of AR and VR in HR-driven training could help avert a knowledge crisis from the mass retirement of baby boomers.

- Blockchain. A database technology for distributing records across a chain of computers, blockchain makes the data essentially permanent and largely immune to hacking. Bitcoin is the most famous blockchain application, but companies have begun to explore the potential for sharing employee records and other HR information. Initial uses for blockchain HR technology include securely transmitting payroll documentation, candidate credentials and employment contracts. However, significant technical hurdles and distrust sown by high-profile cryptocurrency fraud will have to be overcome for blockchain to see widespread adoption.

- Diversity and inclusion. Programs to combat discriminatory employment practices and individual behavior go back to the 1960s, but the Black Lives Matter protests of 2020 were what finally forced a corporate reckoning. HR software vendors responded with new D&I features, including specialized learning content and AI tools intended to remove bias in hiring.

- Mental health. Workers' struggles with isolation and stress from COVID-19 lockdowns and remote-work expectations sparked renewed interest in supporting mental health on par with physical health. Employers are increasingly providing mental health apps and portals in their benefit packages.

- Remote and hybrid work. The COVID-19 lockdowns forced most white-collar employees to work from home. When restrictions were lifted, companies investigated a new hybrid model that combined home and office. The physical dispersal of the workforce has driven demand for video conferencing software, team collaboration tools and other hybrid workplace technologies. HR software vendors have responded with new features for remote performance management and recruitment, employee engagement, monitoring and wellness.

- Robotic process automation. By mimicking human actions, RPA "bots" -- some capable of AI-based decision-making -- can execute common HR processes, such as benefits selection, expense reimbursement and resume-sorting faster and more accurately. Most vendors have included RPA in HR products in recent years.

Editor's note: Vendors were chosen based on TechTarget editors' coverage of the HR technology market and reports from market research firms such as Forrester and Gartner.

David Essex is an industry editor who covers enterprise applications, emerging technology and market trends, and creates in-depth content for several TechTarget websites.